Understanding one’s financial health is pivotal in navigating the complex world of personal finance. In today’s fast-paced economic environment, knowing how to track your net worth can significantly impact your financial growth and decision-making. Your net worth is a comprehensive reflection of your financial stability, comprising all your assets minus liabilities. By regularly monitoring your net worth, you gain insight into your financial progress, identify areas needing improvement, and set meaningful financial goals. This article delves into the importance of tracking your net worth and the steps to effectively manage it, empowering you to enhance your financial well-being.

What Is Net Worth and Why It’s Important

Net worth is a measure of an individual’s or entity’s financial health. It is calculated by subtracting total liabilities from total assets. Assets may include anything of value such as real estate, investments, cash, and personal property. Liabilities are obligations or debts owed to others, such as mortgages, loans, and credit card balances.

Understanding your net worth is crucial because it provides a snapshot of your current financial standing. It helps in assessing whether you are financially thriving, stable, or in precarious circumstances. When you know your net worth, it empowers you to make informed financial decisions and set goals for future wealth accumulation.

Regularly tracking your net worth allows you to spot financial trends, identify areas for improvement, and manage your financial risks effectively. As a result, you can be strategic about saving, investing, and spending, which leads to improved financial security and peace of mind. Ultimately, knowing your net worth helps ensure you have the resources needed for a comfortable lifestyle now and in the future.

List Your Assets and Liabilities Clearly

In order to accurately track your net worth, it’s imperative to clearly list all your assets and liabilities. Begin by identifying your assets, which are items of value you own. These include savings, retirement funds, property, and any other investments.

Next, compile a list of your liabilities, which are financial obligations or debts you owe. Common liabilities might include mortgage balances, student loans, credit card debt, and other forms of personal loans.

Clearly delineating your assets and liabilities is a crucial step in understanding your financial standing. It not only provides insight into where you determine your financial strength but also helps in strategizing for future financial goals.

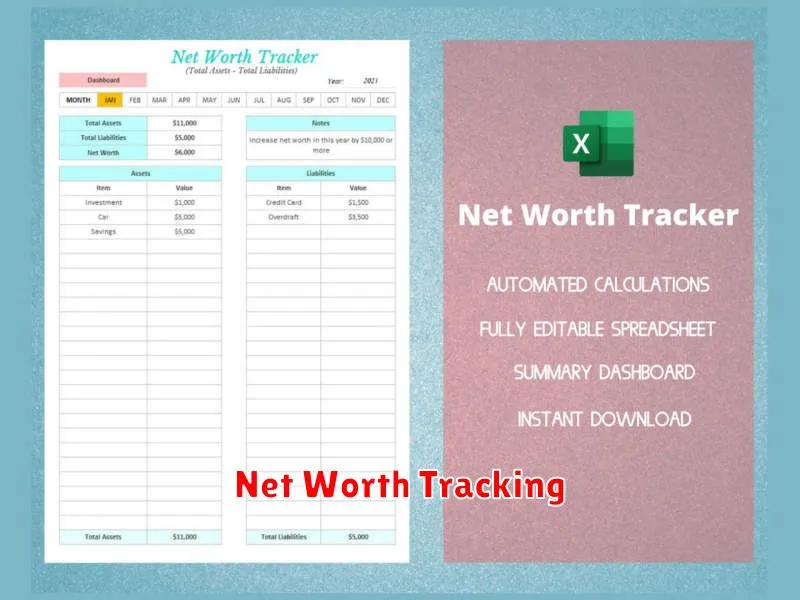

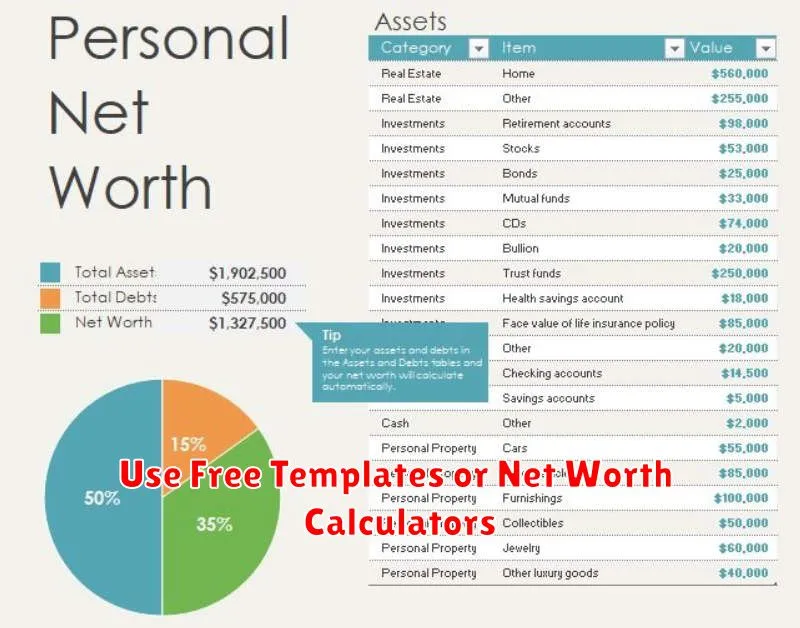

Use Free Templates or Net Worth Calculators

Tracking your net worth can be simplified by utilizing free templates or net worth calculators. These tools offer structured frameworks that help in listing and classifying your assets and liabilities, ensuring nothing is overlooked.

Free templates are readily available online and often come in the form of Excel sheets or Google Sheets. They are highly customizable, allowing you to tailor the categories and fields to suit your personal financial situation. These templates typically include sections for all common types of assets and liabilities, providing comprehensive coverage for effective tracking.

On the other hand, net worth calculators are even more user-friendly. These tools are available on various financial websites and apps, automating the process by calculating net worth once you enter required data. They ensure accuracy and efficiency, offering real-time insights into your financial health.

By leveraging either free templates or calculators, you streamline the process of tracking your net worth, which is essential for making informed financial decisions and understanding your overall financial position.

Update Your Net Worth Monthly or Quarterly

Regularly calculating your net worth is essential for maintaining a clear picture of your financial health. By updating your net worth on a monthly or quarterly basis, you can ensure that your financial goals remain aligned with your current situation.

Monthly updates provide a frequent and detailed look at your finances, allowing you to swiftly adjust your budget and spending habits in response to changing circumstances. This regularity can be particularly beneficial if you frequently engage in activities that significantly alter your financial position, such as investing or making large purchases.

On the other hand, quarterly updates offer a balance of detailed oversight and manageable commitment. For those who find monthly calculations too time-consuming, quarterly updates can still keep you informed while allowing for meaningful observation of financial trends and adjustments over a longer period.

Ultimately, the choice between a monthly or quarterly update schedule should be based on your personal preference and financial activity level. Consistent updates, regardless of frequency, will help keep your finances on track and support the achievement of long-term financial goals.

Watch Trends Instead of Daily Changes

When monitoring your net worth, focusing on long-term trends rather than daily fluctuations can provide a more accurate picture of your financial health. Daily changes can be influenced by market volatility, unexpected expenses, or temporary windfalls, which do not necessarily reflect your true financial position.

By observing trends, you gain insights into your financial progress over time. This perspective allows you to make informed decisions about budgeting, investing, and saving. It also helps you to set realistic goals and measure your progress against them.

Furthermore, tracking trends rather than daily changes can reduce anxiety associated with frequent monitoring. Instead of reacting to every market movement, you can stay focused on your long-term financial strategy, which is more likely to lead to sustainable growth and success.

Ultimately, prioritizing trends over daily changes provides a clearer, more meaningful view of your financial well-being, enabling you to make better strategic decisions for your future.

Celebrate Growth, Even Small Wins

Tracking your net worth is not just about calculating numbers; it’s about acknowledging your financial journey. Every incremental gain in your net worth, no matter how small, signifies progress and reinforces positive financial habits.

By focusing on growth, even minor improvements, you maintain motivation and strengthen your resolve to attain larger financial goals. Small wins provide validation and encourage you to stay committed to your long-term financial strategy.

Recognizing these achievements can also help you identify what strategies are working well. Celebrating small victories boosts confidence and inspires you to continue making informed and strategic financial decisions.

Use It as Motivation, Not Comparison

When you track your net worth, it’s important to focus on leveraging the information as a source of motivation rather than engaging in destructive comparisons with others.

Each person’s financial journey is unique, influenced by varying circumstances, goals, and resources. Instead of measuring your progress against others, use your net worth as a personal benchmark to chart your financial growth and set meaningful goals.

By viewing your net worth as a tool for personal growth, you can maintain a positive mindset and stay motivated to make financial decisions that align with your aspirations and values.