In today’s rapidly changing economic landscape, achieving financial independence is more crucial than ever. Whether you’re looking to escape the cycle of living paycheck to paycheck or aiming to build a strong financial foundation, taking control of your personal finances is a vital step towards financial freedom. This comprehensive guide, titled “How to Take Control of Your Finances in 7 Simple Steps,” will equip you with the necessary tools and strategies to effectively manage your money. From budgeting effectively to smart investing, each step has been carefully curated to help you develop a sustainable and successful financial plan. Dive in to discover actionable solutions that will empower you to make informed financial decisions and pave the way towards a more secure future.

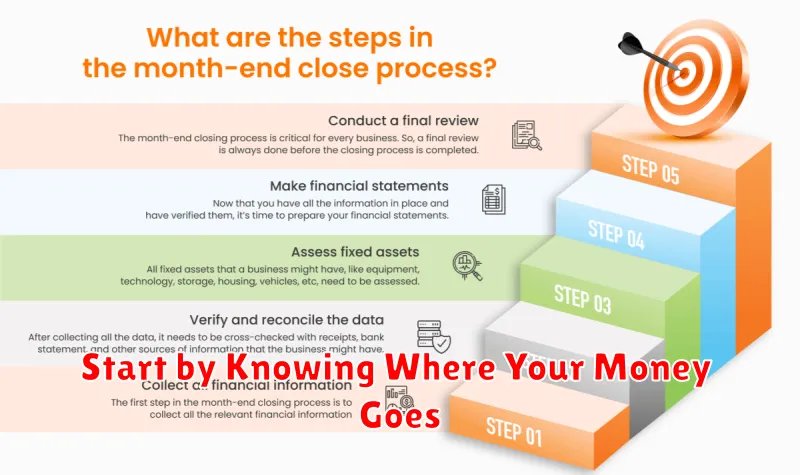

Start by Knowing Where Your Money Goes

When aiming to take control of your finances, the first step is to understand where your money is currently being spent. This involves tracking your expenditures diligently to get a clear picture of your monetary outflow.

Begin by collecting all your receipts, bank statements, and any financial documents reflecting your spending habits from the past few months. Categorize these expenses into broad groups such as necessities, luxuries, and unexpected costs. This categorization will help you identify patterns and areas where you may be overspending.

To simplify this process, consider using budgeting apps or financial tools that automatically track and categorize your expenses. These tools not only help you visualize your spending but also offer insights and alerts on your financial health.

By understanding your current spending habits, you lay the groundwork for making informed financial decisions, setting a budget that works, and ultimately taking control of your financial future.

Set Clear Short-Term and Long-Term Goals

Establishing financial goals is crucial in gaining control over your finances. It’s important to set both short-term and long-term objectives to provide direction and purpose. Short-term goals could include creating a budget for the next three months or saving for a small vacation. These objectives are typically achievable within a year and serve as stepping stones toward more extensive financial aspirations.

On the other hand, long-term goals could involve saving for retirement, buying a home, or building a comprehensive investment portfolio. These initiatives require a more extended timeframe, often several years or even decades, and demand a more strategic approach. Having well-defined targets enables you to allocate resources effectively and track progress regularly, reinforcing financial discipline and confidence.

Ensure your goals are specific, measurable, achievable, relevant, and time-bound (SMART). Regularly assess and adjust them as your financial situation and priorities evolve. By having clear goals, you lay down a structured plan, significantly enhancing your ability to manage finances efficiently and achieve financial stability.

Create a Personalized Budget System

To effectively manage your financial resources, it is crucial to establish a budget system that is tailored to your specific needs. A personalized budget helps you allocate your income to various expenditures, ensuring you are both prepared for expected costs and capable of handling unexpected expenses.

Begin by examining your monthly income and categorizing your spending. Common categories include essentials, savings, and discretionary expenses. This allows for a clearer picture of where your money goes and where adjustments can be made.

Next, set realistic financial goals that align with your lifestyle and priorities. This could include saving for a vacation, emergencies, or future investments. Having clear objectives motivates you to stick to your budget.

Regularly track your finances and adjust the budget as necessary. Use digital tools or apps to monitor your spending habits, making it easier to maintain financial discipline and make informed decisions.

By creating a personalized budget system, you pave the way to achieving a more organized and stress-free financial life, empowering you to take control of your finances with confidence.

Track All Spending Daily for 30 Days

One of the most effective ways to gain control over your financial situation is to meticulously track all your spending every day for a month. This practice provides a comprehensive view of where your money is going, revealing spending patterns and identifying unnecessary expenses.

Begin by recording every purchase and payment immediately after they occur. Use digital tools such as budgeting apps or spreadsheets to keep a detailed log, or opt for a traditional approach with a written journal. The key is to be consistent and thorough.

At the end of the month, categorize your expenses into groups such as groceries, dining, utilities, and entertainment. Analyzing these categories will uncover areas where you can potentially cut back or reallocate funds towards more essential needs or savings goals.

By adopting this tracking habit, you develop a greater awareness of your financial behavior. It empowers you to make informed decisions and enables you to implement meaningful changes to improve your financial well-being. With dedication and attention to detail, tracking your spending is a fundamental step toward financial control and success.

Automate Bill Payments and Savings

Managing your finances can often be overwhelming, but with strategic planning, you can lessen the burden. One effective method is to automate your bill payments and savings. This ensures that all your essentials are paid on time and allows you to save without even thinking about it.

By setting up automatic payments, you reduce the risk of missing due dates, which can lead to late fees and a damaged credit score. Most banks and bill companies offer easy options to schedule payments to be debited directly from your account.

Additionally, automating your savings is a great way to build financial security. You can instruct your bank to transfer a certain amount of money into your savings account each month. This method allows you to save effortlessly and ensures you are consistently adding to your savings without the temptation to spend the money elsewhere.

The key to financial control is to make your money work for you even when you’re not thinking about it. By setting up these automated processes, you take a significant step toward achieving financial independence and stability.

Cut Out Financial Distractions and Bad Habits

To gain control over your finances, it is essential to eliminate unnecessary distractions and break free from bad financial habits. Start by identifying what consistently diverts your attention away from your financial goals. These distractions can be anything from frequent impulse buys to persistent subscription services you no longer use.

Begin by conducting a thorough audit of your spending habits. Analyze your expenditure patterns to pinpoint areas where distractions are most prevalent. This process helps to uncover recurring patterns of inefficiencies and leaks in your budget. Awareness is crucial; you cannot fix what you do not acknowledge.

Once identified, take actionable steps to eliminate these distractions by setting strict limits. Implementing a monthly budgeting plan or installing spending alert apps on your devices can be significantly beneficial. Such measures help maintain your focus and ensure you are not swayed by non-essential expenses.

Moreover, consider replacing bad habits with positive alternatives. For instance, instead of habitually eating out, plan your meals and cook at home. This not only saves money but also enhances your culinary skills. Engaging in community financial literacy programs can similarly replace the habit of uninformed spending with educated financial decisions.

By systematically cutting out distractions and reshaping costly habits, you lay a solid foundation for more effective management of your finances. With discipline and dedication, you will find yourself steadily moving toward your fiscal objectives with clear and unwavering focus.

Review and Reflect Weekly on Your Progress

Taking control of your finances is an ongoing process that requires regular evaluation. Every week, allocate some time to review your financial activities, assess your progress, and reflect on the areas needing improvement. This practice ensures that you remain focused on your financial goals and recognize any patterns or habits that might be influencing your financial health.

During your review, examine your spending habits and compare them against your budget. Identify any discrepancies and analyze their causes to prevent future occurrences. It is essential to maintain a balance between necessary expenses and discretionary spending to ensure financial stability.

Setting small, achievable goals for the following week can help maintain motivation and direction. Tracking your progress will not only highlight successes but also spotlight areas for growth, allowing you to make the necessary adjustments to stay on course. This systematic weekly reflection is a powerful tool to effectively manage and control your finances over the long term.