In today’s fast-paced world, managing personal finances can often feel overwhelming, leading to stress and uncertainty about the future. Crafting a personal budget that you can actually follow is an invaluable skill that provides clarity and peace of mind. This article will guide you through the steps necessary to build a practical budget, empowering you to make informed financial decisions, prioritize spending, and achieve your financial goals. Whether you’re new to budgeting or seeking to refine your approach, learning how to create a realistic and sustainable budget is essential for ensuring long-term financial health and stability. Let’s embark on this journey to give you the tools and confidence needed to take control of your financial future.

Why Most Budgets Fail and How to Fix Yours

Creating a personal budget can be a daunting task, yet many people find themselves frustrated when their budgets do not work as planned. One key reason most budgets fail is that they are often too restrictive, leaving no room for unexpected expenses or personal indulgences. Over time, this rigidity can lead to budget fatigue, causing individuals to abandon their financial plans altogether.

Another reason is the failure to track expenses consistently. It’s essential to regularly monitor spending to ensure it aligns with the budget. Without consistent tracking, you lose clarity on where your money goes, making it difficult to stay within your financial limits.

Additionally, many fails to set realistic goals. People tend to create budgets based on ideal circumstances, ignoring potential life changes or emergencies. A successful budget acknowledges the unpredictability of life and builds in a buffer for surprises.

To fix these issues, start by crafting a flexible budget that accommodates occasional treats and unexpected costs. Consistent expense tracking is essential, utilizing apps or spreadsheets to maintain awareness of financial habits. Finally, set achievable goals, adjusting them as circumstances evolve. With these strategies, you can build a personal budget that you can consistently follow.

Calculate Your Real Monthly Income

To effectively build a personal budget, it is crucial first to determine your real monthly income. Start by listing all sources of income, such as your salary, bonuses, and any side earnings. Make sure to focus on net income, which is the amount you receive after taxes and other deductions.

Accurate income calculation involves considering any irregular earnings. For example, if you receive bonuses or occasional freelance payments, average these amounts over a year and add them to your monthly income. This gives you a more realistic depiction of what you have available monthly.

Once your total monthly income is calculated, remember to adjust for fluctuations. For instance, if your work hours vary and affect your pay, budget based on your minimum income and adjust for higher months only when necessary. This method ensures your budget remains effective and prevents you from overspending.

By ensuring your income calculation is thorough and accurate, you lay a solid foundation for effective budgeting. This approach enables you to allocate resources appropriately and meet your financial goals.

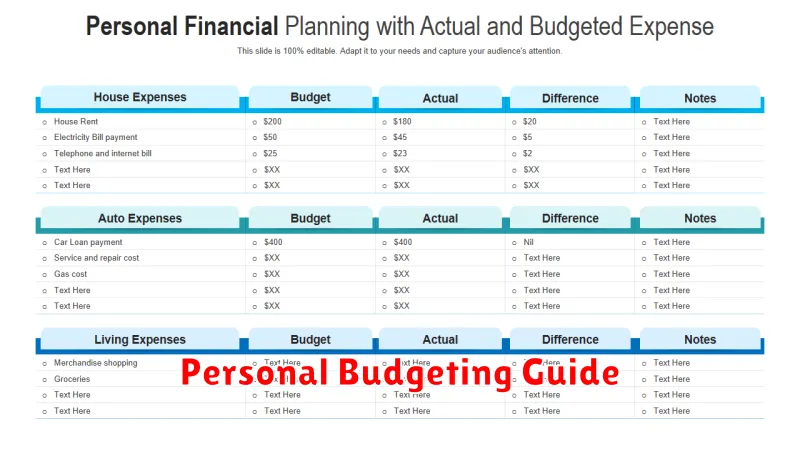

List All Expenses Honestly, Including Hidden Ones

When embarking on the journey of creating a personal budget, it is crucial to account for all expenses. Begin by listing obvious expenses such as rent, utilities, and groceries. However, many individuals fail to consider hidden costs that can disrupt budgeting efforts.

Hidden costs often include annual fees, subscriptions, and unexpected repairs. It is essential to examine bank and credit card statements to uncover these overlooked expenditures. Incorporating these into your budget will provide a realistic financial outlook.

Furthermore, setting aside funds for emergencies can buffer against unforeseen expenses. Recognizing and accounting for all spending builds a solid financial foundation and increases the likelihood of adhering to your budget plan.

Categorize Spending into Needs, Wants, and Goals

Building a personal budget requires an understanding of how to categorize your spending accurately. Dividing expenses into needs, wants, and goals can be an effective strategy to ensure that your financial resources are allocated wisely.

Needs are essential expenses that you must cover to maintain a basic standard of living. These include rent or mortgage payments, utilities, groceries, transportation, and healthcare. Prioritizing your needs ensures that your fundamental expenses are consistently met, which serves as a stable foundation for your budget.

On the other hand, wants are non-essential expenditures that enhance your lifestyle but are not necessary for survival. This category may include dining out, entertainment, or luxury purchases. While it’s important to enjoy life, limiting spending on wants allows you to allocate more towards your financial objectives.

Finally, goals represent future financial ambitions such as saving for retirement, a house, or an emergency fund. Prioritizing your goals alongside your needs fosters long-term financial security. By clearly categorizing your expenses, you ensure that your budget reflects your values and aspirations, leading to sustainable money management.

Use a Budgeting Method That Fits Your Lifestyle

Creating a personal budget that you can consistently follow begins with choosing a budgeting method that aligns with your lifestyle. There are several budgeting techniques available, each with its own advantages. The key is to understand how these methods can be adapted to suit your habits and financial goals.

One popular approach is the 50/30/20 rule, in which 50% of your income covers necessities, 30% is allocated to discretionary spending, and 20% goes toward savings and debt repayment. This method is ideal for individuals who prefer a straightforward framework that balances essential expenses with personal enjoyment.

Alternatively, the envelope system provides a more hands-on strategy. By allocating cash into specific envelopes for different spending categories, this system encourages discipline and helps you avoid overspending. It is particularly useful for those who thrive on visual accountability and prefer physical money management.

Another method is the zero-based budget, which involves planning for every dollar you earn, ensuring that your income minus your expenses equals zero. This approach provides a comprehensive view of where your money is going and is best suited for those who value detailed tracking and planning.

Ultimately, choosing a method that matches your lifestyle and financial goals will make budgeting sustainable and effective. Regularly revising and adjusting your chosen method as your circumstances change will further ensure it remains a valuable tool in your financial toolkit.

Track Progress Weekly and Adjust Monthly

One of the keys to a successful personal budget is consistent tracking and evaluation. By monitoring your budget on a weekly basis, you can maintain a clear picture of your financial health and ensure you stay on track.

Every week, dedicate a specific time to review your income and expenses. This regular check-in allows you to immediately identify any discrepancies or unexpected costs that might arise, preventing them from accumulating into a larger issue. Document each transaction meticulously and ensure that your spending aligns with your budget goals.

At the end of each month, analyze the data gathered from your weekly reviews. This is an opportunity to assess whether your budget reflects your current financial situation and life circumstances. If you find that certain categories consistently exceed their limits, consider either reducing expenses or adjusting the budget to accommodate these changes.

Monthly adjustments are crucial in keeping your budget realistic and achievable. They allow you to refine your financial strategy based on actual performance rather than assumptions or outdated expectations.

By regularly tracking and adjusting your budget, you can cultivate a disciplined approach to managing your finances, ultimately helping you achieve your financial goals efficiently.

Don’t Forget to Include Fun Money

When constructing a personal budget, it’s essential to allocate a portion for enjoyment. This often overlooked category is what we call “fun money.” Incorporating fun money into your budget does not signify financial irresponsibility; rather, it’s a strategic step towards a sustainable budget.

By setting aside a designated amount for leisure activities, you not only reward yourself for sticking to your financial goals, but you also mitigate any feelings of deprivation that can lead to budget fatigue. This balance ensures that you remain committed over the long term.

Defining the right amount for fun money is subjective and should align with your overall financial objectives and obligations. Consider a percentage-based allocation of your disposable income after essential expenses. This ensures that your spending on fun remains proportionate to your financial situation.

Ultimately, the inclusion of fun money acts as a pat on the back and subtly reinforces the healthy habit of budgeting. It serves as a reminder that managing your finances should not be synonymous with sacrificing all forms of joy and entertainment.

Stay Accountable With a Budgeting Partner

Managing personal finances can be challenging, but introducing a budgeting partner can boost your commitment and discipline. By working alongside someone who shares similar financial goals, you can foster a sense of accountability and encouragement.

A budgeting partner can help in setting realistic and achievable financial targets. Regular check-ins can keep both of you motivated and prevent you from deviating from your planned budget. It’s important that you select someone who you can openly communicate with and trust, as financial matters often require honest discussions.

The mutual support not only reinforces financial discipline but also introduces a new dimension of shared financial learning. Exchanging ideas and strategies with your partner can reveal new perspectives on budgeting and saving. The collaboration can transform budgeting from a solitary task into a more engaging and rewarding experience.