Embarking on the journey into adulthood is both exhilarating and daunting, especially when it comes to managing finances. Financial independence often marks a significant milestone for young adults, making the mastery of critical financial steps imperative for securing a stable future. In this guide, we’ll delve into the essential steps every young adult should take to establish a solid financial foundation. From creating a foolproof budget to understanding the intricacies of credit scores and investments, these actionable insights aim to empower young individuals to make informed financial decisions. Whether you’re navigating your first paycheck or contemplating your initial investment portfolio, understanding these fundamental concepts is crucial to achieving long-term financial success.

Open a Bank Account and Learn to Manage It

One of the initial financial steps every young adult should undertake is opening a bank account. This step serves as the foundation for managing personal finances, providing a secure place to store funds while tracking income and expenses efficiently. Selecting a bank account that best suits your needs is crucial, considering factors such as fees, accessibility, and additional features like online banking.

Once your bank account is open, it’s vital to learn how to manage it effectively. Monitoring your account regularly helps you understand your spending habits and identify areas for improvement. Setting up alerts for low balances or unusual transactions can assist in maintaining financial health. Furthermore, young adults should take advantage of tools such as budgeting apps or online platforms that help track expenses and savings plans.

Additionally, becoming familiar with banking terms and services, such as interest rates, overdrafts, and account fees, is essential. This knowledge not only helps prevent financial errors but also allows you to make informed decisions regarding your money. By managing your bank account responsibly, you lay the groundwork for a stable financial future, encouraging disciplined spending and saving habits early on.

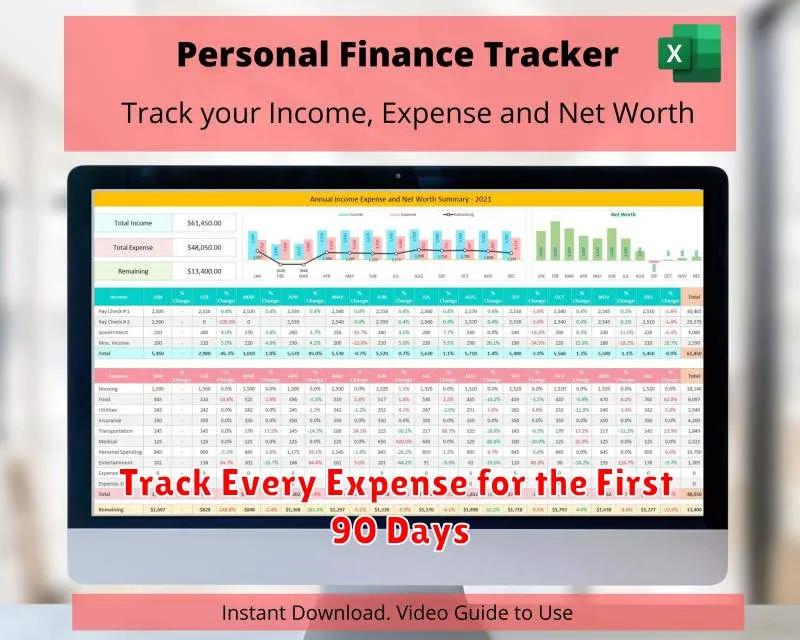

Track Every Expense for the First 90 Days

One of the most crucial steps a young adult can take towards financial independence is to track every expense meticulously for the first 90 days. This practice provides a clear understanding of spending habits, helping to identify areas where adjustments might be necessary. Regularly monitoring expenses ensures that spending aligns with personal financial goals.

Start by keeping an accurate and detailed record of all expenditures, no matter how small. Utilize budgeting tools or apps that can automate the tracking process, making it easier to categorize and analyze where your money is going. By reviewing these records weekly, you can gain valuable insights into your financial behavior.

With a comprehensive expense record, young adults can better distinguish between needs and wants. This discernment is essential for creating a realistic budget and setting a solid foundation for future financial planning. Adjustments made based on the initial 90-day tracking period can lead to improved spending decisions and increased savings potential.

In conclusion, by diligently tracking every expenditure for the first 90 days, young adults empower themselves with the knowledge and skills necessary to manage their finances effectively. This disciplined approach sets the stage for long-term financial success and stability.

Start Saving Even Small Amounts Regularly

Embarking on your financial journey as a young adult can seem daunting, but one of the most crucial steps is to start saving, even if it’s with small amounts. Many often underestimate the power of accumulating savings routinely, yet this habit can catalyze significant financial stability over time.

Commit to setting aside a portion of your income regularly, no matter how modest it might seem. This practice establishes a discipline that is vital for effective money management. By incorporating saving into your financial routine early, you cultivate a mindset oriented towards financial responsibility and sustainability.

Even small savings can build a financial cushion, enabling you to handle emergencies without resorting to loans or credit. Moreover, regular savings can eventually fund larger investments, which can be instrumental in achieving long-term goals, such as purchasing a home or planning for retirement.

The key is consistency; set a target amount, however small, and adjust your budget to accommodate it. Utilize automatic transfers to ensure your savings account steadily grows without the temptation to skip contributions. Over time, these small, regular savings can provide peace of mind and financial security, establishing a solid foundation for your future financial endeavors.

Understand Taxes and How They Affect Your Pay

Understanding taxes is crucial for every young adult as they embark on their financial journey. Taxes are mandatory financial charges imposed by the government on individual income, and they directly affect how much money you take home from your paycheck.

When you receive a paycheck, it is usually less than the amount you earn because of various tax deductions. These deductions can include federal income tax, state and local taxes, Social Security, and Medicare, among others. Each of these is deducted to fund important government programs that benefit society as a whole.

Federal income tax is progressive, meaning its rate increases as your income grows. This is designed to ensure that everyone pays their fair share, but it also means that understanding which tax bracket you fall into can help you better manage your finances.

Young adults should take the time to learn how tax withholding works. Employers typically withhold a portion of your paycheck for taxes, but if too much is withheld, you’ll receive a tax refund during tax season. Conversely, if not enough is withheld, you may owe money. Ensuring your W-4 form is filled out correctly can help prevent these issues.

Finally, remember that understanding tax credits and deductions can significantly affect your taxes. Credits like the Earned Income Tax Credit (EITC) or deductions for student loan interest can reduce the amount of tax you owe or increase your refund, providing much-needed financial relief.

Create a Simple Budget with a Free Template

As a young adult stepping into financial independence, mastering budgeting is a crucial skill. Creating a simple budget can help you manage expenses and save for future goals. A free template can be an excellent starting point to ease into this process.

Firstly, download a free budgeting template that can easily be found through a quick online search. These templates often come in formats like Excel or Google Sheets, making them easy to customize and update. Ensure that the template covers essential categories such as income, fixed expenses (like rent and utilities), variable expenses (such as groceries and entertainment), and savings.

Once you have your template, input your monthly income and classify your expenses. Be honest and realistic about your spending habits to create a picture that accurately reflects your financial situation. Categorizing expenses allows you to see where your money goes and helps identify areas where you can cut back.

Consistency is key, so make it a habit to update your budget regularly. Keep track of your expenses and compare them to your projected budget. Doing so will enable you to make informed decisions about your spending and savings strategies.

By using a free budget template, you can take control of your finances with ease and confidence. It’s a simple yet effective tool to ensure that you meet your financial commitments while also saving for the future.

Avoid Credit Card Debt from the Beginning

As a young adult stepping into financial independence, one of the most crucial steps is to avoid accumulating credit card debt early on. Credit cards can be a double-edged sword, offering convenience and rewards on one side, but potentially leading to financial pitfalls on the other. Understanding how to use them wisely is essential to maintaining solid financial health.

First and foremost, it is imperative to create a budget that accommodates your monthly income and expenses. This helps ensure that you only charge what you can afford to pay off by the end of the billing cycle. Always strive to pay your balance in full each month to avoid accruing high-interest charges that can quickly snowball into unmanageable debt.

Additionally, familiarize yourself with the terms and conditions of your credit card agreements. Knowing your credit limit, interest rates, and any fees associated with your card can prevent unpleasant surprises. Opt for cards with low or zero annual fees and consider those offering rewards or cash-back benefits that align with your spending habits.

Lastly, strive to build and maintain a strong credit history by not only paying on time but also by keeping your credit utilization low. A good credit score will serve you well in the future, whether you’re applying for loans, mortgages, or new credit cards.

By taking these proactive steps, you lay a foundation for a stable financial future, steering clear of the stress and burden that come with mounting credit card debt.

Build a Basic Emergency Fund

As young adults embark on their financial journey, establishing a solid foundation is crucial. One of the first and most vital steps is to build a basic emergency fund. This fund acts as a safety net, providing financial security in times of unforeseen expenses such as medical emergencies, car repairs, or sudden unemployment.

To start, aim to save at least three to six months of living expenses. This amount should cover essential costs like housing, utilities, and groceries. By having this buffer, you can avoid the need to rely on credit cards or loans, thereby maintaining your financial independence.

Begin by setting realistic savings goals. Many find it helpful to automate their savings by setting up monthly transfers from checking to savings accounts. This ensures consistent growth of your emergency fund without the temptation to spend.

Remember, the goal is not immediate, but rather a steady accumulation. Celebrate small milestones as you build toward a comfortable reserve. A well-funded emergency fund is a critical component of financial stability and provides peace of mind as you navigate life’s uncertainties.

Set One Financial Goal for the Year

Establishing clear financial objectives is crucial for young adults who are navigating their initial steps into the financial world. A well-defined goal sets the foundation for sound financial planning and cultivates disciplined financial behavior.

Begin by identifying one significant financial milestone you wish to achieve by year’s end. This could be building an emergency fund, paying off a portion of debt, or saving for a specific purchase, such as a down payment on a vehicle or future education.

Setting a singular financial goal prevents overwhelming feelings and enhances focus, allowing you to track your progress more effectively. To boost your likelihood of success, incorporate a realistic timeline and clear actionable steps required to accomplish this objective.

Consistently monitor your progress, celebrate small wins, and make adjustments as necessary. This diligence will establish a pattern of setting and achieving financial goals, greatly influencing your financial stability in the future.