In today’s unpredictable economic environment, having an emergency fund has become an essential component of achieving personal financial stability. Whether it’s unexpected medical expenses, sudden job loss, or urgent home repairs, life’s uncertainties can significantly impact one’s financial health. An emergency fund acts as a financial safety net, providing a buffer that allows individuals to navigate these challenges without resorting to debt or derailing long-term financial goals. This article delves into the reasons why establishing a robust emergency fund is critical for anyone seeking to maintain control over their personal finances and secure a stable future.

The Role of Emergency Funds in Financial Health

Establishing an emergency fund plays an instrumental role in maintaining financial health. It acts as a financial buffer, safeguarding individuals from unexpected expenses such as medical emergencies, car repairs, or sudden unemployment. This proactive approach ensures that such unforeseen events do not derail one’s long-term financial goals.

An emergency fund enhances financial resilience by providing a readily accessible pool of money, thereby reducing reliance on high-interest loans or credit cards. This not only aids in managing financial crises but also aids in preserving one’s credit score, an essential component of financial stability.

Moreover, having an emergency fund contributes to mental well-being. Knowing that funds are available in times of need can reduce stress and anxiety, allowing individuals to focus on productive and long-term financial planning rather than immediate financial crises. In essence, an emergency fund is a crucial pillar for ensuring personal and financial stability.

How Much Should You Actually Save?

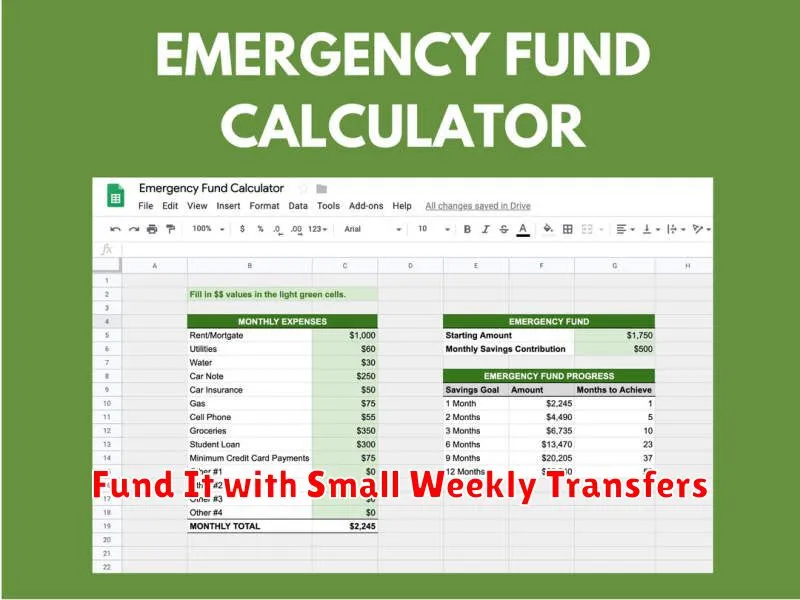

Determining the right amount to save for an emergency fund is vital for achieving personal stability. Financial experts often suggest having a reserve that covers three to six months’ worth of essential living expenses. This range accounts for unforeseen circumstances such as job loss or major medical emergencies.

The precise amount, however, can vary based on individual situations. If you have recurring monthly expenses such as rent, utilities, groceries, and transportation, calculate them first. Multiply your monthly expenditure by three to six to estimate your target emergency fund.

Consider also your job security and other sources of income. If your employment is stable or you have multiple income streams, you might lean towards the lower end of the spectrum. Conversely, if you have a variable income or face potential unemployment, a larger buffer can provide added security.

Lastly, adjust your savings goal regularly to align with changes in your financial obligations or lifestyle. By maintaining an adequately sized emergency fund, you can safeguard yourself against uncertainties and maintain financial independence.

Open a Separate Account for Emergency Use Only

One of the most crucial steps in establishing an emergency fund is to open a separate account dedicated solely to this purpose. This ensures that the funds remain easily accessible during emergencies, yet are kept distinct from daily expenses and savings goals.

Maintaining a separate account signifies the importance and specific use of these resources, reducing the temptation to dip into these reserves for non-emergency purposes. It also helps maintain a clear record of your fund’s growth and ready availability when faced with unexpected situations.

Consider opting for a savings account or a money market account. These types of accounts often provide the necessary liquidity while potentially offering interest benefits, allowing your emergency fund to grow over time.

By isolating your emergency savings, you create a financial barrier that promotes discipline and solidifies your commitment to personal stability. This specific account acts as a financial buffer that ensures you are prepared for unforeseen challenges without disrupting your primary financial plans.

Fund It with Small Weekly Transfers

Building an emergency fund does not have to be daunting. A practical approach is to allocate small, regular amounts from your weekly earnings. This strategy eases the financial strain and helps create a consistent savings habit.

Consider setting up an automatic transfer from your checking account to a savings account each week. Even as little as $10 can add up over time, ensuring your savings grows steadily without disrupting your monthly budget.

Small, consistent contributions are more manageable than trying to set aside a large sum at once. As your financial situation improves, you can increase the transfer amount, accelerating the growth of your emergency fund.

The key is commitment. Regular small transfers instill discipline and mitigate the risk of dipping into these funds for non-emergencies. Over time, this method fosters financial stability and provides peace of mind.

Avoid Tapping Into It for Non-Emergencies

An emergency fund serves as a crucial financial buffer, designed to safeguard against unexpected expenses that could otherwise lead to significant financial distress. It is important to understand that accessing these funds for non-emergencies can undermine their primary purpose and jeopardize your financial stability.

While it may be tempting to dip into the emergency fund for discretionary expenses or non-essential purchases, doing so can deplete resources meant for genuine emergencies. These funds should be preserved for situations such as unforeseen medical expenses, home repairs, or sudden job loss. By avoiding its use for non-emergencies, you maintain a financial safety net that can provide peace of mind during truly challenging times.

Moreover, consistently accessing these funds for non-urgent matters can instill poor financial habits and undermine your ability to prioritize saving. Instead, consider establishing a separate savings account for non-essential spending, so the integrity of your emergency fund remains intact. Discipline in maintaining the emergency fund solely for its intended purpose is vital to ensuring your personal financial stability and readiness for future challenges.

Rebuild Quickly After Using It

An emergency fund serves as a vital buffer during unforeseen financial challenges, providing you with immediate access to funds when you need them most. After relying on your emergency reserve, it’s crucial to replenish it promptly to ensure personal stability.

Start by reviewing your budget and adjusting discretionary expenses to allocate funds specifically for rebuilding your emergency savings. Consistently setting aside even a small amount over time can significantly accelerate the rebuilding process.

Utilize any extra income, such as bonuses or tax refunds, to contribute directly to your emergency fund. By ensuring your fund is restored quickly, you maintain a safeguard against future uncertainties.

Peace of Mind That Protects You From Debt

An emergency fund serves as a crucial safety net, offering peace of mind and shielding you against unexpected financial shocks. When unforeseen expenses arise, such as medical emergencies, sudden car repairs, or urgent home maintenance, having a solid reserve of funds can prevent you from needing to rely on credit cards or loans, which typically come with high interest rates.

An emergency fund provides you with the confidence to navigate life’s uncertainties without the constant worry of accruing debt. By setting aside even a small portion of your income regularly, you can build a fund that cushions against potential financial hardships.

Knowing that you have a financial buffer allows you to approach life’s challenges with a sense of security. It grants you the freedom to make sound decisions without the burden of debt hanging over your head. Ultimately, an emergency fund not only protects your financial well-being but also enhances your overall personal stability.