In today’s fast-paced world, managing personal debt has become a crucial skill for financial stability and peace of mind. Whether you’re dealing with student loans, credit card balances, or other financial obligations, understanding how to eliminate personal debt strategically can transform your financial future. This guide will equip you with essential strategies to tackle debt efficiently, offering insights on prioritizing payments, cutting unnecessary expenses, and leveraging financial resources wisely. By implementing these approaches, you can pave the way to achieving financial freedom and securing a sustainable economic outlook.

Know Exactly How Much You Owe

One of the first steps towards strategically eliminating personal debt is knowing precisely how much you owe. Without a clear understanding of your total financial obligations, planning an effective debt reduction strategy becomes challenging. Begin by gathering all your financial statements and organizing them in a systematic manner. This includes credit card balances, loans, and any other outstanding debts.

Once compiled, create a detailed list of each debt, noting the amount owed, due dates, and the interest rates associated with each. This detailed overview will not only help in prioritizing which debts need immediate attention but also in minimizing interest expenses over time.

An accurate assessment of your liabilities also enables you to track progress effectively. Regularly updating this list will provide you a transparent view of your debt status, assisting in maintaining your commitment to achieving a debt-free life.

Create a Simple Debt Tracking Sheet

One of the first steps in effectively eliminating personal debt is creating a debt tracking sheet. This tool will enable you to monitor your debt obligations and plan your repayment strategy. Constructing a tracking sheet might seem daunting, but it can be done easily with just a few steps.

Begin by listing all your debts. Include crucial details such as the lender’s name, total amount owed, interest rate, minimum payment due each month, and the payment due date. This clarity will provide better insights into where your financial resources are allocated.

Using a tool such as a spreadsheet (e.g., Microsoft Excel or Google Sheets) can help you organize this information effectively. You can then use formulas to calculate the total debt and track the progress as you make payments. This visibility is key to managing your debt actively and strategically.

Regular updates to this sheet are essential. By documenting monthly payments, observing changes in debt balances, and adjusting strategies as needed, you’ll ensure that your debt reduction efforts remain on track. A well-maintained debt tracking sheet not only keeps you informed but also motivated as you witness your progress towards becoming debt-free.

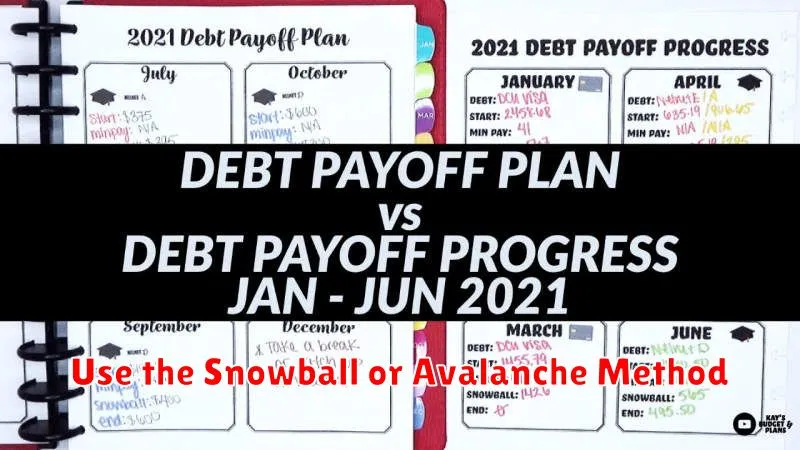

Use the Snowball or Avalanche Method

When it comes to eliminating personal debt strategically, choosing the right method can make a significant difference. Two popular strategies are the Snowball Method and the Avalanche Method, each offering unique advantages to suit different financial situations and personality types.

The Snowball Method focuses on paying off debts from the smallest balance to the largest. By tackling the smallest debts first, you can achieve swift victories, which help build momentum and boost morale. This approach capitalizes on psychological motivation, allowing you to see quick results and remain engaged in the process of debt elimination.

Alternatively, the Avalanche Method prioritizes paying off debts with the highest interest rates first. This strategy minimizes the total interest paid over time, leading to greater long-term savings. While it might take longer to see the first debt disappear, the financial benefits are substantial, especially for those dealing with high-interest debt.

Choosing between these methods depends on your financial goals and personal preferences. If you seek immediate gratification and motivation, the Snowball Method might be more suitable. However, if your priority is reducing the overall cost of debt, the Avalanche Method may be the better choice.

In the quest to eliminate personal debt strategically, understanding and selecting either the Snowball or Avalanche method can provide a clear and effective path forward, ultimately leading you to financial freedom.

Cut Unnecessary Spending to Free Up Funds

When aiming to eliminate personal debt strategically, one of the most effective strategies is to scrutinize daily expenditures for unnecessary costs. By identifying and cutting out these expenses, individuals can redirect funds towards debt reduction.

Start by evaluating monthly statements and categorizing spending into essentials and non-essentials. Essentials generally include necessities like housing, utilities, and groceries, whereas non-essentials often encompass dining out, entertainment, and subscription services.

Once identified, consider reducing frequency or completely cutting out any non-essential items. For example, preparing meals at home rather than eating out can lead to significant savings. Similarly, canceling unused or seldom-used subscriptions can free up additional funds.

Additionally, implementing a budget can help maintain focus on essential spending, ensuring that money is allocated precisely to cover needs while preventing unnecessary expenditures.

By rigorously controlling spending, individuals not only save money but also create a disciplined financial environment. This newfound financial freedom can dramatically accelerate the process of debt elimination when savings are promptly redirected towards paying off liabilities.

Increase Income with Temporary Side Hustles

One of the most effective strategies to eliminate personal debt is to increase your income. Engaging in temporary side hustles can provide you with the additional funds needed to address your financial obligations more aggressively.

Temporary side hustles offer flexibility and can be tailored according to your skills and available time. Popular options include freelance work, gig economy opportunities like driving for ride-sharing services, or participating in online surveys and tasks.

These endeavors allow you to monetize your spare time and skills efficiently. By devoting a few hours each week, you can make a significant dent in your debt, while also gaining new experiences and connections that could potentially benefit your primary career in the long run.

Avoid Adding New Debts While Paying Down Old Ones

As you aggressively work towards reducing your existing debt, it is crucial to avoid accumulating new debt. This can undermine your progress and extend the time it takes to attain financial freedom. Being disciplined in this regard helps keep your financial goals in focus and accelerates the debt elimination process.

A fundamental step is to prioritize needs over wants. Before making any purchase, ask yourself if it is a necessity or a temporary desire. This reflection can prevent impulse spending, which is a common precursor to new debt.

Moreover, utilizing a budget plan can help manage your finances more effectively. A budget provides a clear overview of your income versus expenses, enabling you to allocate funds wisely without resorting to credit for unforeseen expenses.

Consider establishing an emergency fund to cover unexpected costs. Even a modest fund can provide a buffer that prevents the need to take on debt when emergencies arise.

Additionally, focus on using cash or debit cards instead of credit cards. This approach avoids the temptation of spending money that isn’t immediately available, thus helping you maintain a debt-free commitment while reducing existing liabilities.

Stay Consistent and Reward Milestones

One of the critical steps in successfully reducing personal debt is to maintain consistency in your approach. This means sticking to a budget plan and making regular payments without fail. Consistency ensures you are always moving forward, no matter how daunting the debt may seem.

Alongside consistency, it is important to recognize and reward the milestones you achieve along the way. Paying off a credit card or achieving a saving target are milestones worthy of celebration. These rewards should be reasonable and within your budget. Acknowledging your progress can motivate you to continue with your financial strategy and ultimately eliminate personal debt.

Combining constant effort with a system of rewards for milestones helps to maintain momentum and provides positive reinforcement, making the process more engaging and less taxing. This approach keeps your debt-reduction journey sustainable over the long run.