In today’s fast-paced world, the challenge of balancing wants versus needs is a common dilemma faced by many individuals striving for financial stability and personal fulfillment. Understanding the difference between your essential needs and your desires is critical in making informed decisions that promote a well-rounded life without the burden of guilt. This article delves into effective strategies for distinguishing between these two often-conflicting aspects, ensuring you can enjoy what you love while securing what is necessary. From practical budgeting tips to personal insights, discover how you can prioritize your needs without sacrificing your wants, leading to a more harmonious and guilt-free lifestyle.

Define What’s Truly a Need in Your Life

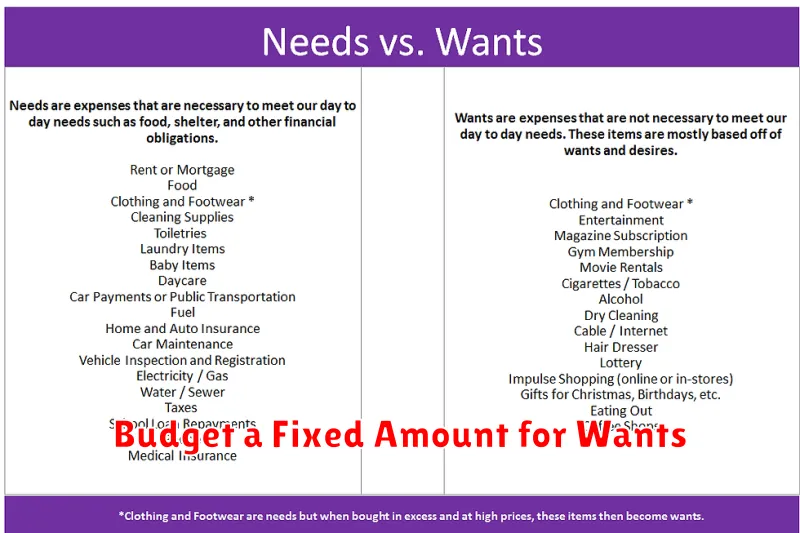

Understanding the differences between wants and needs is crucial to creating a balanced lifestyle. In essence, a need is something essential for your survival and wellbeing, while a want is something you desire but can live without.

To accurately define your needs, consider what is fundamental to your physical health and safety such as food, shelter, and clothing. It’s important to reflect on the elements crucial for your emotional and mental health as well, like basic healthcare and social interaction.

Engage in self-reflection to critically assess your lifestyle. Ask yourself questions about what aspects of your life are indispensable and support your primary responsibilities. By identifying these needs, you create a framework that helps distinguish between what is essential and what is supplementary.

This differentiation allows you to prioritize more effectively, ensuring that your fundamental needs are met first before pursuing additional desires. This conscious decision-making process leads to a more controlled and guilt-free approach to managing your finances and resources.

Create a Simple Filter for Every Purchase

To manage your finances and maintain a healthy balance between desires and necessities, it’s crucial to implement a simple filter for every purchase decision. This approach helps you understand the distinction between what you want and what you need, allowing you to make more informed decisions without guilt.

Begin by asking yourself a set of predefined questions before making a purchase. Consider if the item is a necessity or a luxury. Will it bring genuine value to your life, or is it an impulse buy fueled by temporary emotions?

Another effective strategy is to evaluate the item’s longevity and its potential for long-term satisfaction. Will the excitement fade quickly, or is it a purchase that will serve you well over time?

Moreover, setting a budget for discretionary spending can guide your decisions and help prevent overspending on non-essentials. Such financial boundaries empower you to prioritize needs without sacrificing occasional wants.

By applying these filters, you can make purchases that align with your values and financial goals, ensuring every decision contributes positively to your overall well-being.

Use a ‘Pause and Prioritize’ Approach

In the quest to balance wants and needs without succumbing to guilt, adopting a ‘Pause and Prioritize’ approach can be transformative. This method entails taking a deliberate moment to reflect before making decisions, which helps to distinguish between what is truly essential and what is merely desirable.

Start by pausing whenever you face a decision involving expenditure or time investment. This pause allows you to consider the long-term implications of your choice and whether it aligns with your core needs. During this time, ask yourself probing questions such as, “Is this an urgent necessity, or can it wait?” This self-inquiry brings clarity and reduces impulsiveness.

The next step is to prioritize. Assign a hierarchy to your desires and requirements. Knowing what holds the utmost importance mitigates feelings of guilt associated with forgoing unneeded wants. By explicitly understanding and writing down priorities, you create a guideline that assists in resolving internal conflicts over needs versus wants judiciously.

This balanced approach ensures that you remain mindful and intentional in your decisions, mitigating feelings of guilt, and allowing you to focus on fulfilling both needs and reasonable wants in a structured manner.

Budget a Fixed Amount for Wants

Creating a balanced budget is a key step in distinguishing between wants and needs without inciting guilt. Start by assessing your financial situation objectively. Calculate your monthly income and subtract your essential expenses, ensuring that you fulfill your needs such as housing, food, and utilities first.

Once essential expenses are covered, allocate a specific amount of money for your wants. This predefined budget acts as a guiding framework, allowing you to indulge in non-essential items or activities within a rational limit. By setting these boundaries, you can enjoy your wants without compromising your financial stability.

A fixed budget for wants also promotes better financial discipline and decision-making. It encourages you to prioritize what truly brings value or joy, helping you avoid impulsive purchases. Additionally, knowing that you can occasionally spend on wants without guilt supports a healthier relationship with money.

In conclusion, allocating a fixed budget for wants ensures that you can enjoy life’s pleasures while maintaining financial responsibility. This balance fosters peace of mind and allows for guilt-free enjoyment.

Reflect on Emotional Triggers That Lead to Wants

Balancing wants and needs requires an understanding of the emotional triggers that often lead to desires. These triggers can stem from various psychological factors, such as stress, societal pressure, or the need for validation.

When you’re stressed, you might find yourself inclined to indulge in retail therapy, mistaking temporary relief for genuine necessity. At the same time, social media can amplify feelings of inadequacy, pushing you to crave items that symbolize status or fulfillment.

It is essential to recognize these triggers consciously, allowing you to assess whether a desire truly aligns with your values and long-term goals. This reflection helps in ensuring that your spending aligns more closely with your true needs rather than fleeting wants.

Don’t Eliminate All Fun—Just Structure It

Striking a balance between wants and needs without the burden of guilt can be a challenging endeavor. However, it’s crucial to recognize that life should not be devoid of enjoyment. The key lies in structuring your fun activities to ensure they coexist with your essential responsibilities.

Planning plays a pivotal role in this balancing act. By allocating specific times for leisure within your schedule, you can ensure that relaxation and entertainment fit harmoniously with your obligations. This approach minimizes the risk of indulgence taking precedence over necessary tasks.

Additionally, setting boundaries aids in maintaining this harmony. Decide in advance how much time or resources you are willing to dedicate to non-essentials, preventing potential overindulgence.

Moreover, incorporating fun that aligns with your values and goals can enrich your life without inducing guilt. Engaging in activities that contribute to personal growth or family bonding, for example, can make leisure time feel more rewarding.

In conclusion, cultivating a structured approach to enjoyment ensures that you fulfill both your wants and needs, fostering a well-rounded, guilt-free lifestyle.

Re-evaluate Monthly What Qualifies as a Need

In order to effectively balance wants and needs, it is essential to periodically assess what qualifies as a true need. Performing a monthly evaluation allows individuals to adapt to changing circumstances and priorities, ensuring resources are allocated judiciously.

Begin by examining recurring expenses and questioning their necessity. Items such as subscriptions or memberships often become so routine that they are mistaken for needs. By actively evaluating each expense, individuals can distinguish between genuine necessities and luxuries that no longer serve their current lifestyle.

Additionally, life changes such as moving, starting a new job, or undergoing health adjustments can alter what is considered essential. Regularly revisiting and updating the list of needs ensures alignment with present circumstances, promoting financial stability without incurring unnecessary guilt over unexamined spending.

This reflective practice not only aids in maintaining economic balance but also nurtures a sense of control and clarity over one’s financial decisions, ultimately leading to a more informed and intentional approach to money management.