In today’s fast-paced financial landscape, understanding how to set and stick to realistic financial goals is crucial for sustained economic health. Achieving personal financial stability requires not just ambition, but a well-crafted plan that acknowledges both your ambitions and limitations. Whether you’re aiming to build an emergency fund, save for retirement, or reduce existing debt, establishing clear objectives is the first step toward transforming aspirations into reality. This guide will delve into the essential strategies for setting achievable financial objectives and maintaining the discipline required to see them through successfully. Embrace the journey towards financial freedom by implementing practical steps that can significantly enhance your monetary well-being.

Differentiate Between Dreams and Goals

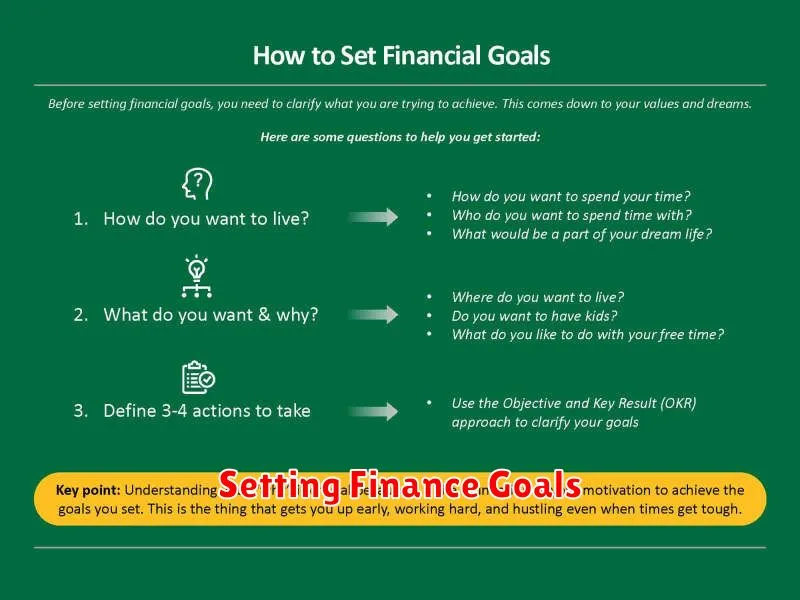

When setting financial goals, it’s crucial to understand the distinction between dreams and goals. While dreams are aspirations that inspire and fuel your imagination, goals are the concrete steps and actions you take to transform these dreams into reality.

Dreams often lack a defined timeline and can feel intangible and distant, but goals require a realistic plan and a clear deadline for achievement. For instance, dreaming of financial independence is a great starting point. However, establishing specific goals such as saving a certain amount each month or reducing debt by a set percentage by the year’s end are actionable targets that pave the way to this dream.

Moreover, goals need to be rooted in practicality and crafted within your current financial reality. This ensures that your aspirations do not remain mere wishes but evolve into achievable accomplishments. By delineating between dreams and goals, you can craft a more structured and effective approach to achieving your financial aspirations, ultimately turning your ideal scenarios into real-world outcomes.

Set SMART Financial Objectives

When it comes to achieving your financial goals, it’s essential to employ the SMART criteria. This method ensures that your objectives are designed to be effective and attainable. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. By adhering to these principles, you can create a roadmap to financial success.

Specificity in goal setting helps to clarify what you want to accomplish. Rather than saying “I want to save money,” specify the exact amount you plan to save, such as “I aim to save $5,000 within a year for a vacation.”

Next, ensure your goals are measurable. By using quantifiable indicators, such as a monthly savings target, you can easily track your progress and make necessary adjustments.

Your objectives should also be achievable. It’s important to set goals that are realistic given your current circumstances and resources. Consider your income, expenses, and existing commitments when planning your financial path.

Goals must be relevant to have a meaningful impact on your financial situation. Align your objectives with broader life ambitions, like buying a home or retiring comfortably, to maintain motivation.

Finally, every objective should be time-bound. By establishing a deadline, such as reaching a savings goal within six months, you create a sense of urgency and a timeframe for assessment.

Integrating the SMART approach in setting your financial objectives not only enhances clarity but also significantly boosts the likelihood of sticking to and achieving your financial goals.

Break Big Goals into Monthly Milestones

When setting financial goals, it is crucial to divide ambitious objectives into manageable and actionable steps. This not only makes the goals seem less daunting, but also provides a clearer roadmap toward achieving them.

Monthly milestones serve as a checkpoint and enable you to track your progress effectively. By focusing on smaller, more tangible accomplishments, you maintain motivation and can adjust your strategies as needed.

Begin by identifying your ultimate financial goal. Then, break this down into monthly targets that are both realistic and align with your overall timeline. For instance, if your big goal is to save $12,000 in a year, aim for a $1,000 increase in savings each month.

This method encourages a disciplined approach and provides an immediate sense of achievement. It helps prevent feelings of overwhelm and allows you to celebrate small victories, further fueling your dedication toward meeting your larger financial aspirations.

Use Visual Tools Like Charts or Vision Boards

When setting and adhering to realistic financial goals, it’s imperative to employ visual tools that help clarify your objectives and track your progress. Charts and vision boards are two effective methods to visually represent your financial aspirations and achievements.

Charts allow you to outline your income, expenses, savings, and other financial aspects in a comprehensible manner. By transforming numerical data into visual representations, such tools make it easier to identify trends and areas requiring attention. For instance, employing a simple bar graph to visualize monthly expenditures can reveal patterns of spending that might require adjustments.

On the other hand, vision boards serve as a forceful motivator by showcasing your long-term financial goals. Such boards blend textual and visual elements to inspire action and provide a constant reminder of what you aim to achieve. Including images or phrases related to specific objectives, such as purchasing a house or achieving debt freedom, can aid in maintaining focus.

Ultimately, these visual tools not only enhance clarity but also maintain your commitment to your financial path. Whether it’s through detailed charts or inspirational vision boards, integrating visual strategies is a practical step toward achieving your financial objectives.

Celebrate Small Wins Without Overspending

When working towards your financial goals, it’s important to acknowledge the small victories along the way. These milestones not only boost your motivation but also reinforce your commitment to your financial journey.

Celebrating achievements doesn’t mean you have to spend excessively. Instead, consider low-cost or no-cost activities that provide just as much joy and satisfaction. For instance, you might choose to enjoy a cozy dinner at home with your favorite meal, or treat yourself to a relaxing day in nature.

Furthermore, recognizing your progress can also be accomplished through non-material rewards. Sharing your success with friends or family, or even taking time to reflect on how far you’ve come, can be immensely fulfilling.

Ultimately, the goal is to maintain a balance between celebrating your achievements and staying within your financial limits. By practicing mindful celebrations, you can ensure that these small rewards do not derail your overall financial plan.

Create a Daily Habit That Aligns With Your Goals

Creating a daily habit is a powerful way to ensure you remain focused on your financial objectives. Habits form the backbone of sustained success, acting as consistent reminders of your commitments and aspirations.

Begin by identifying small, actionable activities that directly contribute to your financial goals. This might include setting aside a certain amount of money every day, or reviewing your spending patterns each evening. The key is to integrate these actions seamlessly into your routine, so they become as automatic as brushing your teeth.

Consistency is crucial. Regular behaviors, no matter how minor, accumulate over time to produce significant results. Ensure the habits you choose are realistic and achievable, which helps avoid burnout and discouragement. Consider using tools or reminders to help you stay on track, such as setting alarms or utilizing budgeting apps.

The alignment of your daily habits with your overarching financial goals ensures that every day, regardless of other variables, moves you a step closer to financial security and independence.

Review and Adjust Goals Every Quarter

Regularly evaluating your financial goals every quarter is crucial to ensuring they remain realistic and aligned with your evolving financial landscape. Quarterly reviews provide an opportunity to reflect on both achievements and shortcomings, allowing you to make necessary adjustments.

During these reviews, assess the effectiveness of the strategies you’ve implemented. Determine whether your current savings and spending habits support your goals. If circumstances have changed, such as a change in income or unexpected expenses, recalibrate your goals to better fit your new context.

Additionally, quarterly reviews give you the chance to celebrate small victories. Recognizing your progress can boost motivation, reinforcing your commitment to achieving your larger financial objectives. Set actionable steps for the next quarter, ensuring they are both attainable and strategically aligned with your overarching goals.

By embracing a regular quarterly review process, you’ll be equipped to adapt your financial plan proactively, keeping your financial goals relevant and within reach.